Pakistan’s economy will grow 5.8 percent this fiscal year, the fastest pace in 13 years, the country’s de facto finance minister, Miftah Ismail, said on Thursday, a day before he announces the 2018/2019 budget.

Pakistan’s economy has seen growth accelerate in recent years but it has not been without problems. The World Bank and the International Monetary Fund have warned that the country’s macro-economic picture has been deteriorating as its current account deficit widens.

Pakistan’s foreign reserves have also been dwindling amid a consumer boom and a spike in imports, including machinery for Chinese projects that form part of the Belt and Road initiative.

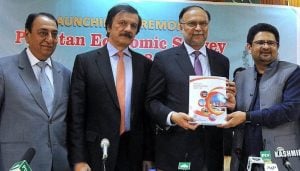

Ismail, speaking to reporters alongside Pakistan’s Planning Commission Minister Ahsan Iqbal at the launch of the Economic Survey of Pakistan, said growth for 2016/2017 (July-June) has been revised to 5.4 percent from 5.28 percent.

He said the country’s economic outlook is in a strong position, adding that agriculture, industry and services grew 3.81 percent, 5.80 percent and 6.43 percent, respectively.

“This year the growth we have achieved is 5.79 per cent,” Ismail said. Average inflation of the current fiscal year has been contained at 3.78 percent, he said, compared with 4.01 percent in the same period last year. “When we came in 2013, the inflation was 7.9 percent,” he said.

The government has in recent months devalued the rupee, imposed tariffs on imported goods and sought to boost exports to reduce growing balance of payments pressures.

Ismail said that he supported devaluing the rupee against the dollar twice in recent months to arrest the current account deficit, which had also put pressure on country’s foreign reserves.

A decline in exports in the last two to three years – the main reason for the current account deficit – and disappointing foreign inflows and slow global growth in international trade flows remained the risks and challenges on domestic and external front, the economic survey highlighted.

However, it said, the declining trend has started to fade out. The current fiscal year has seen a continued rise in exports with a 12.0 percent growth. Imports have slowed to 16.6 percent compared with 48 percent at the start of the year.

TAX Exemptions

Tax exemptions rose by 30 per cent to Rs540.98 billion from last year, the second highest growth in the five-year tenure of PML-N despite three successive years of reductions in overall tax exemptions.

The single-largest contributor to the surge in tax exemptions is the Free Trade Agreement (FTA) with China, where the figure came in at Rs92.4bn, climbing by 46pc from last year’s Rs63bn.

A huge benefit of Rs34.7bn has been extended for balancing, modernisation and replacement of plant and machinery. The revenue loss due to interest on house building is estimated at Rs1bn.

A tax credit of Rs3.32bn has been extended on the establishment of new industrial undertakings.

The rest of the exemptions are shared by relief on education expenses, sales to registered taxpayers, export of IT services.

Sales tax exemptions rose to Rs281.05bn in 2017-18 from Rs250bn a year ago, reflecting an increase of 12.4pc.

The customs exemptions went up to Rs198.15bn from Rs151.7bn a year ago, an increase of 30.6pc. Close to half this amount was due to imports exempted under the FTA with China.

FTAs with Malaysia and Sri Lanka also witnessed growth in terms of tax exemption cost. The cost of revenue because of FTA with Sri Lanka was Rs2.8bn, and Malaysia Rs2.67bn. Under preferential trade agreement (PTA) with Indonesia, the revenue cost was estimated at Rs3.86bn, and South Asian Free Trade Area agreement at Rs1.32bn.

No exemption cost was reported on trade with Iran while in the case of Economic Cooperation Organisation countries the cost of exemption went up to Rs274m this year from Rs73m a year ago.

In the last year survey, the exemptions to independent power producers (IPPs) were not mentioned. But in Economic Survey 2017-18, the tax loss due to exempt business income claimed by IPPs were estimated at Rs18bn.

Upward trend was seen in tax exemption cost due to rising preferential imports under FTA with China. The tax exemption cost rose nearly to R32bn in 2017-18 from Rs22bn in 2012-13.

Another important aspect mentioned in the Economic Survey is a meagre amount of Rs397m duty exemption cost on account of CPEC-related imports. The figure is small despite government claims that large amount of machinery is being imported from China for CPEC investments.

Current Account Deficit

The current account deficit surged by 50.5 per cent to $12 billion (3.8pc of GDP) during the July-March period. This was mainly due to 20.6pc widening in the trade deficit, which amounted to $22.3bn.

Remittances

Nationalization of jobs and introduction of value-added tax in Saudi Arabia has reduced remittances from the kingdom. Also the UAE increased the cost of living for unskilled low-income workers. The overall decline in unskilled occupation is 28.51pc during July- December period of 2017-18 compared to same period last year, said the survey.

With a growth of 3.6pc in remittances during July-March the government expects to achieve the target of $20.6bn for FY18, it added.

Energy Sector

Government on Thursday claimed to have added 39 power projects with a total generation capacity of 12,230 megawatts during its five-year term ending on May 31, but fell short of telling that the majority of these schemes are yet to start commercial operations.

The Pakistan Economic Survey 2017-18 boasts that the government has also reduced the country’s dependence on expensive oil by improving the energy mix through the addition of coal and (imported) gas-fired generation, and encouraging investment in renewable energy. But it admits that the share of hydropower in overall energy mix has decreased in the last five years. The survey blamed lower water availability for the reduction in the share of hydropower in the energy mix but fails to mention very low investments made in this sector.

Public Debt

Pakistan total public (domestic and foreign both) debt has grown by almost 60 per cent to Rs22.8 trillion from Rs14.3tr in four and a half years of the current government’s tenure to December 2017, according to the Pakistan Economic Survey 2017-18 released on Thursday.