Highlights of Pakistan Economic Survey 2021-22

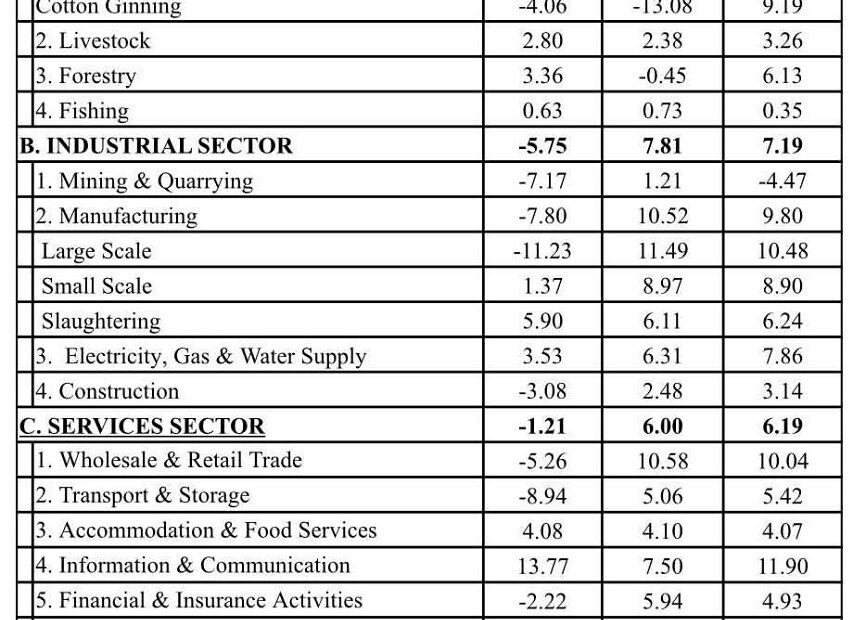

Pakistan government has unveiled economic survey for the year 2021-2022. Following are the key highlights. The real GDP posted a growth of 5.97 percent. For July-April FY2022, the current account deficit remained US$13.8 billion against… Read More »Highlights of Pakistan Economic Survey 2021-22