Mehmood Ul Hassan Khan

United Arab Emirates is already on the path of socio-economic prosperity and diversification of national economy. Despite, havocs of socio-economy in the region and weak economic prospects at international levels, the macro-economy of the UAE stable, strong and sustainable. Even continued global economic and financial crises, tumbling oil markets and freezing credit markets could not produce any substantial dint in the economy of the UAE.

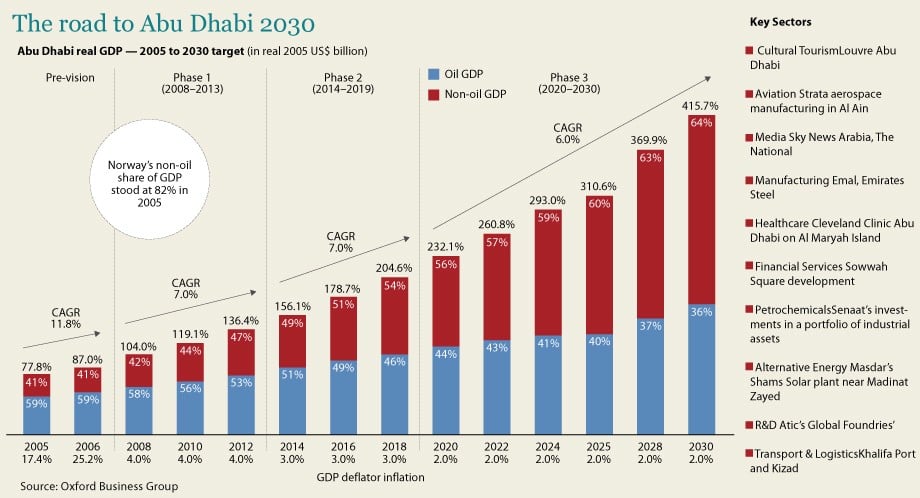

Gradual economic liberalization, public-private sector collaboration, financial and banking reforms, industrialization, and above all diversification drive has made it one of the best destinations of FDIs, and doing businesses and projects. Most recently, Abu Dhabi launched its second five-year financial plan. It sought to set out the emirate’s short-term development priorities/programs to keep it in line with Vision 2030.

It is based on the further economic diversification in eight key sectors namely: cultural tourism, aviation, manufacturing, media, health care, petrochemical, financial services and renewable energy. Moreover, these priorities are reflected in the list of projects announced by the Executive Council in January 2012. The Abu Dhabi Louvre and the Abu Dhabi Guggenheim museums projects on Saadiyat Island will form the cornerstone of Abu Dhabi strategy of diversifying cultural tourism. On the other hand, more focus is given to capacity building in the high-tech aviation industry which will be achieved through Mubadala’s investment in Strata, investment in the aluminium, steel, copper and petrochemicals sectors. Media is the part and parcel of ongoing soft image projection drive in the country. The Executive Council is also reviewing its investments in the media sector to ensure that it generates a contribution to GDP. The proposed investments in the media sector include Abu Dhabi Media, which owns several entities including The National, and twofour54, the media zone.

Private sector is a must for achieving desired goals of socio-economy in the country. It encourages healthy competition between the service entities. It enhances levels of productivity and efficacy. It generates job opportunities. It is embraced as a strategic partner that effectively supports the public sector and contributes to the implementation of the government’s economic plans in the recently announced second five-year financial plan. Electricity, maritime transportation and aviation, among others, are critical areas of involvement for the private sector. It is assured that the investment programme must be carried out by the private sector. Investments in energy and industry would likely be given even more priority in the future. Real estate sector would play an important role in the days to come.

Abu Dhabi initiated a long-term plan for the transformation of the Emirate’s economy, including a reduced reliance on the oil sector as a source of economic activity over time and a greater focus on knowledge-based industries in the future. It provides a comprehensive plan for the diversification of the Emirate’s economy and a significant increase in the non-oil sector’s contribution to the Emirate’s Gross Domestic Product (GDP) by the year 2030.

It identifies two strategic areas for economic development in Abu Dhabi; building a sustainable economy, and, ensuring a balanced social and regional economic development approach that brings benefits to all. It is the result of an integrated effort among a number of public sector and joint public-private sector entities.

Short Term Economic Priorities

• Providing an open, efficient, effective and globally integrated business environment

• Pragmatic fiscal policy which is responsive to economic cycles and growth patterns

• Establishing a resilient monetary and financial market environment with manageable levels of inflation

• Driving significant improvement in the efficiency of the labour market

• Developing a sufficient and resilient infrastructure capable of supporting anticipated economic growth

• Developing a highly skilled and highly productive work force

• Enabling financial markets to become the key financiers of economic sectors and projects.

The Abu Dhabi Economic Vision 2030 establishes a common framework for integrating all policies/plans and programs that contributes to the ongoing development of the Emirate’s economy. It encourages the local and international private sector in the Emirate of Abu Dhabi. It would be a new employment opportunities for the people of the UAE. Abu Dhabi’s vision growth strategy is based on entrepreneurism, qualitative education, innovation and diversification. Small and medium enterprise development is another area of its foremost priority.

According to the recently published report of the Saudi American Bank group (SAMBA), the UAE economy would achieve more than GDP 3.3 percent. High public spending, Dubai’s economic recovery and inflows of safe investment in the UAE economy may boost its economy around 3.3 per cent in 2013 despite an expected fall in crude output. Its real GDP registered around 4.9 per cent in 2011 and 4.2 per cent in 2012 and growth will likely remain relatively high this year while its fiscal system will continue to record largely surpluses.

It further elaborated that most of the 2013 growth would be in the non-oil sector, which could expand by around 4.1 per cent. Growth in the hydrocarbon sector was put at 1.5 per cent, far below the 2012 growth of 5.9 per cent. In current prices, the report showed the UAE GDP would rise by 4.6 per cent to a record high of about $395.8 billion in 2013 from $378.3 billion in 2012.

The report showed an “increasing shift” towards higher capital, including off budget, and social expenditures. The latest figures of the UN Conference on Trade and Development (UNCTAD) said that the UAE has pumped nearly US$55.5 billion into foreign markets over a period of 32 years to emerge as the largest capital exporter in the Arab world. It accounted for nearly 31 per cent of the total Arab foreign direct investment (FDI) outflow of around US$175.8 billion during 1980-2011. The UAE attracted more than US$85.4 billion in terms of FDIs.

Concluding Remarks

Abu Dhabi Vision 2030 is the collective wisdom of its visionary leadership, economic managers and commitment of its important organs and departments alike. It reflects its high aims to achieve high standards of productivity, efficiency and the last but not the least, banking stability. It shows a blueprint of further socio-economic prosperity, knowledge-based economy, innovation and above all diversification of energy demand and supply.

Booming tourism industry, healthy service sector, strong monetary and fiscal indicators and high ratios of inflows of FDIs would be useful to achieve and consolidate the national drive of diversification and lesser reliance of oil and gas traditional resources of energy in the days to come.

Real Estate Abu Dhabi is actually rising up, great strategic plannings comes with great results.