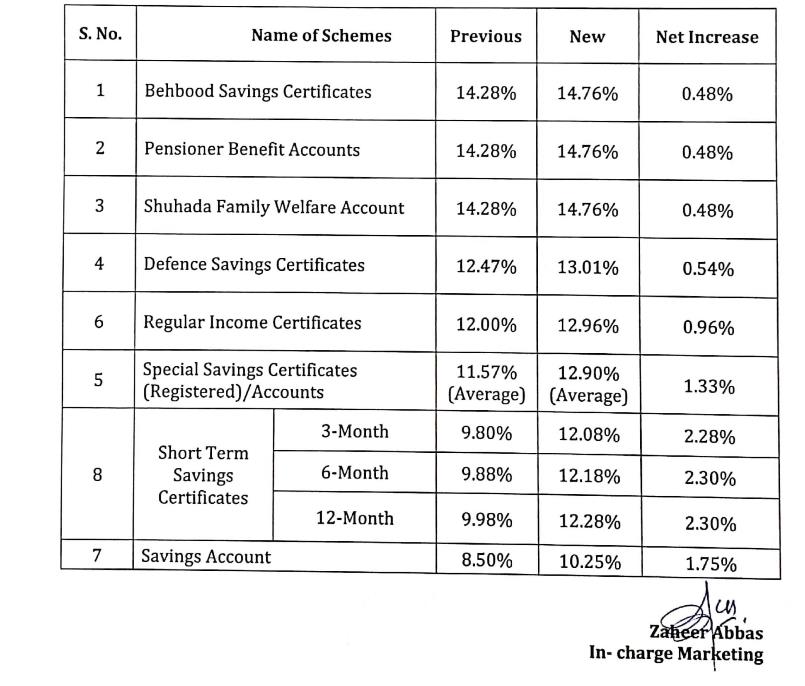

National savings is pleased to announce that the profit rates of National Saving Schemes have been revised upward with effect from 1st July 2019 till further notification.

Profit rates effective from July 2020; https://www.opfblog.com/35654/slight-increase-in-national-savings-profit-rates-july-2020/

Also Read: https://www.opfblog.com/35086/national-savings-reduce-profit-rates-from-nov-2019/

Following are the details of revised NSS rates

Bahbood Savings profit rates

Click here for profit rates on Defense Saving Certificates

Click here for profit rates on Special Saving Certificates

Click here for profit rates on Short Term Saving Certificates

Click here for profit rates on Regular Income Certificates

Aoa sir saving account mn is dafa kitna %laga ha aur kya profit 12 maheeny mn b lagti ha

how can I encash my defence certificats from aboard?

Yeh bohat choor hain mera bi profit per20% tax kiya nawaz govt 10% keti thi 16000 per 3000 tax

Sir 2lac ka 1 sal me kitna prfit mily ga