Mehmood Ul Hassan Khan

UAE celebrated its 44rd National Day on December 2, 2015. UAE a blessed country having strategic visionary leadership and dynamic people celebrated its national day with zeal and pride. They showed full confidence in the diversified but integrated socio-economic policies of their leaders. It is again rigorous persuasion of a balanced foreign policy, global humanitarian assistance, fight against terrorism and extremism.

UAE remained icon of development, dignity, and productivity. It advanced in renewables especially in solar energy. It maintained its position as exporter of renewables in the world (Spain, UK, Jordan etc.).

Despite ongoing regional political instability and incidents of terrorism, UAE’s economy remained productive, healthy and achieved high levels of GDPs in the GCC and MENA. Its banking and finance industry experienced another year of high growth rates.

Secrets of its sustained economic growth are given below as:-

The Standard and Poor’s Agency (2015)

Even, the Standard and Poor’s Agency affirmed that the credit quality classification of the Emirate of Abu Dhabi was “AA+” level. It ruled out any effect of the current oil prices on the development projects that are being carried in the UAE and especially Abu Dhabi. Standard & Poor’s expects Dubai property market to decline 10-20% over the year, especially as many as 20,000 residential units expected to come on line this year alone.

Throughout 2015, its experienced good economic conditions particularly by the non-oil sectors, based on ascending levels of the General Index of Confidence in Business Climate, Consumers Trust Index and the National Family Conditions Observatory Index.

Current Account Surplus

The International Monitory Fund (IMF) estimated the average economic growth of the Emirates expects 3.2 percent in 2015, among the highest in the GCC/MENA. The IMF also expects current account surplus at 5.3 percent in 2015, due to the decline in the international oil prices.

Financial &Banking Industry (2014-15)

The official figures claim that financial sector has seen double-digit growth in 2014 of some 15 per cent, with contributions to GDP reaching Dh122bn. banking sector also continued its positive growth and expansion as the total number of banks active in the country reached 57 banks in addition to the presence of 122 representative offices of foreign banks and total assets of about Dh2.38 trillion at the beginning of 2015.

Banking industry remained strong and stable. According to the Central Bank of the UAE, the monetary supply (N3), in the broad scene was 1377.2 billion Dirhams, end of March 2015, reflecting a rise of 1.2 percent over end of February 2015 figures of 1361.3 billion Dirhams. The gross bank deposit totalled 1.3 percent end of March 2015, in comparison to February figures, hence reaching 1449.3 billion Dirhams. Meanwhile the total bank credit increased to 1410.2 billion Dirhams, end of March, at 1.2 percent compared to February. In local markets, and as per the data of the Abu Dhabi Securities & Commodities Authorities, the shares price index registered 4476.9 points, end of March, retreating by 2.3 percent compared to December 2014.

Strong & Stable Fiscal Indicators (2014-15)

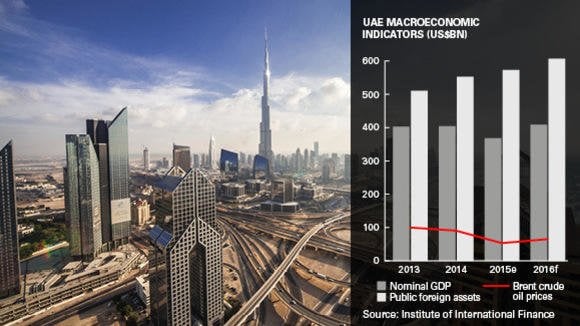

UAE’s Economic Ministry says that consolidated (federal government, Abu Dhabi and Dubai) spending increased by 15 percent during 2005-2014. Ratings agency Fitch estimates that sovereign foreign assets rose to 181 percent of GDP at end-2014 compared with direct sovereign external debt of just 0.6 percent of GDP. Sovereign net foreign assets are forecast at 178 percent of GDP at end-2016 based on conservative assumptions for investment performance.

Tourism

The UAE has already reached a tourism milestone: In 2014, Dubai International Airport claimed the title of the world’s busiest airport, with a total of 70.4 million passengers. The UAE announced in September a US$32 billion expansion project at Al Maktoum International Airport, the emirate’s other airport, to accommodate 200 million passengers annually.

The UAE has continued to launch a wide range of tourism projects and entertainment destinations with some 20 million tourists visiting the seven emirates according to statistics issued by the local tourist authorities.

It continues to consolidate the country’s status as one of the world’s most important travel destinations with the support of the transportation, aviation, marketing and exhibitions industries and bolstered by the UAE’s strong international relations and many international friendships.

Inflation

The IMF expects an average inflation, on the general prices level, to about 2.1 percent compared to 2.3 percent in 2014-15 the lowest since its inception. It has actually saved common people from the inflationary pressure and created a comfort zone for living a decent life.

Contributory Role of Non-Oil Sector (2014-15)

Despite the plunge in oil prices, the UAE’s economy is able to maintain such steadfast growth rate because of its successful diversification policy that is increasingly reliant on non-oil sectors to propel expansion. The contribution of the non-oil sector to the national economy has now reached 68.6 per cent of the constant-price GDP.

The National Bureau of Statistics of Abu Dhabi showed average annual growth of the non-oil activities increased noticeably reaching 12.7 percent in comparison to 2.6 percent in the same quarter of 2013.

Most recent published data by the National Bureau of Statistics showed that the gross total of the foreign trade of non-oil goods, of the UAE was 524.8 Billion Dirhams, during the first half of 2014-15. The imports amounted to 64.8 percent exports of non-oil commodities amounted 12.1 percent and the re-exported stood at 23.1 percent.

Booming Real Estate Sector

The UAE has been named the second hottest market for global residential property investors ahead of Singapore, the United Kingdom and Hong Kong, according to Savills, a UK-based real estate advisor.

Predictions/Expectations

Based on its constant strong and sustainable socio-economic development, UAE will continue to achieve strong growth during 2015 as work continues on a large number of infrastructure projects, such as the expansion of national airports totaling Dh100 billion and building the Union Rail Network, a project worth Dh40 billion, in addition to roads and transport projects, new and improved tourist facilities, electronic infrastructure, real estate, and financial services. Moreover, the continuing rise in government spending and investment and the increase in government and private capital, which amounted to Dh353 billion in 2014, also indicate continued strong growth in 2015.

The Economist Intelligence Unit (EIU) predicts that the UAE economy is expected to grow by roughly 3.6 per cent during the period from 2015 to 2019. It suggests that the growth of the UAE’s real GDP will increase up to 3.2 per cent during the period from 2015 to 2030 and approximately 3.1 per cent from 2015 to 2050. All these above mentioned reports/figures and data clearly show UAE’s rapid socio-economic development having sustained economic prosperity and prospects in the years to come.

Another latest published report of the International Finance (IIF) says that the UAE looks resilient to the slump in oil prices given a diversified economy, excellent infrastructure; a better regulated banking system, political stability, ample foreign assets, and a business/investment friendly policies and tolerant culture. It forecasts UAE’s GDP at 4.1 percent growth in the economy during the current fiscal year.