Mehmood Ul Hassan Khan

Most recently the Kingdom of Saudi Arabia celebrated its 85th National Day. Saudi Arabia holds an important position in the comity of nations and is well-known for its moderate policies. It always works for global peace and collective prosperity of all people, living around the globe. Its shared destiny approach changed the fates of so many struggling people in the world. Moreover, its unmatched regional as well as international humanitarian campaigns and financial generosity succeeded to turn tears into smiles.

It plays an important role in global and regional economic developments. It is a leading player in strengthening partnerships with Arab bilateral and multilateral partners for development assistance and scaling up support for countries in transition in many parts of the world. Despite global weak economic conditions and ongoing financial crunch, it has one of the fastest and most stable economic growth patterns in the world.

Its wise leadership played remarkable role in the onward march of socio-economic prosperity. It introduced many meaningful short, medium and long term economic policies and financial reforms to make its economy competitive in the region and at international stage alike. Numerous schemes of socio-economy have already raised the levels of qualitative life, education, shelter, health and above all trust between the people and the prevailing system in the country.

Many ongoing mega industrial projects have further strengthened the productivity ratios. Inflows of FDIs, massive construction, employment generation, higher education, consumer price stability, and the last but not the least increase in wages has merged the Kingdom as one of the ideal country to live in.

Due to rigorous economic and financial reforms, its macro-economy has enjoyed an unprecedented period of prosperity since 2000. Macroeconomic policies have been business and investment friendly which created many new jobs too. It has consistently implemented initiatives to achieve economic diversification and growth of the non-oil private sector.

According to latest Financial Stability Report (2015), overall, the Saudi economy has continued to perform well despite the recent deterioration in oil prices. All key real and financial macroeconomic indicators showed sustained improvement.

Constant Current Account Surpluses

Constant current account surpluses resulted in the strong build-up of foreign reserves, sizable budget surpluses for several years and significant reduction in the public debt. Real GDP remained stable Consumer Price Index (CPI) inflation remained subdued especially due to the downward pressure on food price inflation in line with falling international food prices.

Monetary Policy

Monetary policy settings also remained supportive of investment and growth. Policy rates remained low continued to perform well as it continues to be supportive to monetary policy, trade, investment and financial assets.

GDP

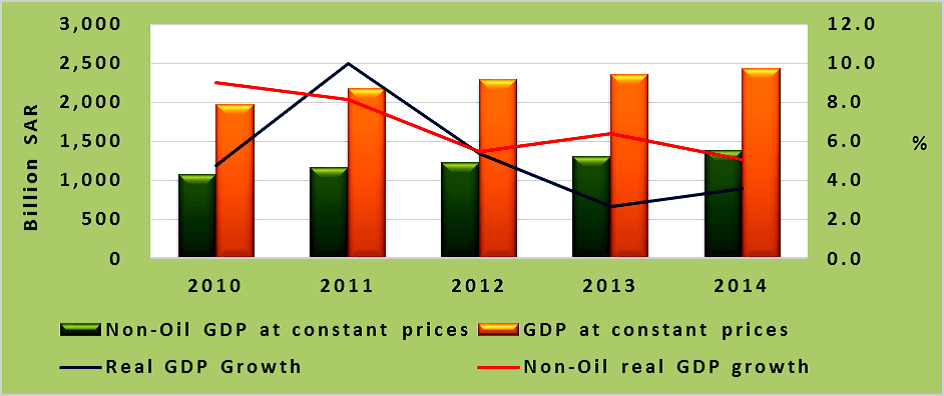

According to latest Financial Stability Report (2015), its real GDP growth has remained strong, averaging 5.2 percent growth over the past five years. Moreover, the non-oil sector continued to show sustained dynamism, with an average growth of 6.8 percent over the last five years. Non-oil sector stayed strong over the past two years growing by 6.4 and 5.1 percent in 2013 and 2014 respectively. The main drivers of private sector growth were construction, manufacturing, and trade that grew by 6.70%, 6.54%, and 5.97% respectively.

Low Inflation Rates

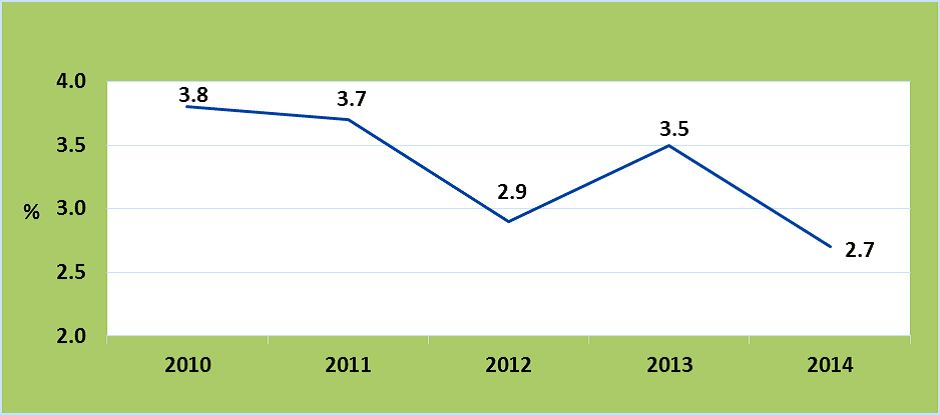

The government succeeded to manage the inflationary pressure within the targets. It has remained subdued over the past five years, as Consumer Price Index (CPI) averaged 3.3 percent. Furthermore, Inflation fell to 2.7 percent in 2014 from 3.5 percent the year before.

Financial Condition Stable & Supportive of Economic Growth

The report indicates that financial conditions in Saudi Arabia have remained stable and supportive of economic growth in recent years. While the monetary base expanded by 8.4 percent annually during 2010-14, M3, which comprises currency in circulation and aggregate bank deposits, grew at 10.7 percent annually during the same period. These conditions resulted primarily from rising current account surpluses, a rapid growth of public spending, and low market interest rates that were set in line with SAMA’s accommodative policy stance.

Build of Foreign Reserves

The recent buildup of SAMA’s foreign reserves to the extent of SAR 2.8 trillion as of December 2014 is yet another positive development set to contribute to the stability of exchange rates.

External Sector

The report further shows that the overall balance of payments position strengthened considerably in recent years. The current account surplus, largely driven by high oil prices and level of production, rose by about seven times in the space of three years to SAR 617.9 billion in 2012 from only SAR 78.6 billion in 2009.

Capital Flows

Financial Stability report says that the net capital flows in Saudi Arabia remained relatively stable through 2013 despite heightened capital flow volatility caused by recent global developments. Net capital flow, reflected by the country’s financial account, increased during the third and fourth quarters of 2013.

Future Prospects

(a) Impact of the drop in oil prices may not materialize in the short to medium term

It is predicted that having strong fiscal position and healthy financial system, the impact of the drop in oil prices may not materialize in the short to medium term.

(b) Government Spending Remained expansionary

Government spending remained expansionary, public debt is at record low levels, and foreign reserves are at high a level which provides a buffer against macroeconomic shocks. Additionally, the quality of credit in the financial sector is high with defaults and non-performing loans at record low levels.

(c) Stability & Sustainability of Macro-Economy

Its macro-economy is likely to maintain stability and sustainability in the long term. Government spending in 2015 will continue to be strong; as of January 2015, there are 439 billion riyals (over $117 billion) in a special government account designated for capital projects such as public housing, schools, hospitals, public transportation, and other major projects. It will continue to boost the Saudi economy and continue the strong growth in the private sector, which is projected to show a steady expansion of 6.0 percent in real terms through 2016.

(d) Strong Capital and Liquidity Position

Saudi Arabia’s macro-economy is stable and sustainable. It has a strong position to mitigate the impact of such an adverse external development. It has strong capital and liquidity position that would largely neutralize the impact of this unfavourable development. The constant government’ support to back up domestic counter-cyclical growth initiatives by virtue of strong fiscal position and large holdings of foreign assets would manage the potential negative consequences. The Saudi financial system is expected to remain strong enough to provide the support required to dissipate the unfavourable impact of adverse future developments and to ensure financial stability.

Selected Economic Indicators 2010 2011 2012 2013 2014

GDP per capita (USD) 19,111 23,594 25,136 24,815 24,451

GDP (USD bn) 527 669 734 744 752

Economic Growth (GDP, annual variation in %) 4.8 10.0 5.4 2.7 3.6

Investment (annual variation in %) 10.6 15.6 5.0 5.6 –

Industrial Production (annual variation in %) 6.2 12.0 4.9 0.2 2.9

Fiscal Balance (% of GDP) 4.4 11.6 13.6 6.5 -1.9

Current Account (% of GDP) 12.7 23.7 22.4 18.2 10.8

Current Account Balance (USD bn) 66.7 159 165 135 81.2

Trade Balance (USD billion) 154 245 247 223 188

Exports (USD billion) 251 365 388 376 343

Imports (USD billion) 97.4 120 142 153 155

Source: IMF (September, 2015)

Massive Economic Diversification

Saudi Arabia is taking all possible measures to further diversify its national economy with the help of different short and long terms programs and policies in the fields of power generation, massive industrialization, renewables, SMEs and private sector etc.

Important Components of Economic Diversification

The Saudi Arabian government has successfully diversified its macro-economy through power generation, telecommunications, natural gas exploration and petrochemical sectors. Saudi Arabia acceded to WTO in 2005 for seeking greater ratios of FDIs and FPIs. It is carried a multi-billion dollar development strategy to build six Greenfield economic cities and industrial zones in the country. By 2020, the industrial cities will generate USD 150 billion in GDP and create 1.3 million jobs. Its sincere efforts to shift from an oil-based economy to a knowledge-based economy are substantiated by the record non-oil exports in 2013-14. Exports oriented policies achieved high current account surplus.