Mehmood Ul Hassan Khan

The United Arab Emirates (UAE) budget 2015 (49.1 billion-dirham) up 6.5 per cent from 2014 has been approved by the government. It is a balanced budget. It is a development oriented budget. It is also business and investment friendly. No new tax has been levied. Despite ongoing fall in international oil prices, its budget included a 2.9 billion increase from last year. It is obvious that its strategy adopted in 2008 to cope with the global economic and financial crises is now paying its dividends. Its Grand National drive of diversification of economy, resources and production has successfully mitigated the negative effects of weak global economy. Its economy is now delinked from crude prices.

Investing in and meeting the needs of its citizens are the cornerstones of the UAE government policies, and represent a top priority in the national agenda for achieving the UAE Vision 2021 which also verifies from the massive allocation of funds to social programs and projects. The budget 2015 also focuses on harnessing financial resources in a sustainable way to serve citizens and provide them with better health, education and social services.

Government’s Expenditures/Sectors % of total budget

Social Sector Dh24 billion 49 %

Government Sector Dh20 billion 41%

Infrastructure and Economic Sector Dh1.8 billion 3.7%

Financial Assets Dh1.6 billion 3.2%

Federal Spending Dh1 billion 2.1 %

Source: Economic Ministry of UAE (2015)

Obaid Humaid Al Tayer, Minister of State for Financial Affairs said “we do not have any crisis and you may recall 2009 when the oil prices reached $35 dollars. Today, the UAE`s budget is not, in any way, linked to the oil prices,”

Social Development: A Main Focus

According to the budget’s document nearly half of the federal budget will be utilized on service projects, social development and social benefits, while 20 billion dirhams (41 percent of the total budget) will be allocated for the government sector affairs. Moreover, education, health care, social affairs and housing services/sectors will be prioritized in the federal budget 2015. According to the decision makers the deficit of 1.53 billion dirhams will be covered from the State General Reserve or revenues, government investment and corporate profits.

Stable Foreign Reserves and Management

The UAE has a stable and sustainable foreign exchange management and reserves totaling 327.6 billion dirhams ($89.3 billion) in July 2014, while Abu Dhabi has the one of world’s biggest sovereign funds, which includes nearly $800 billion of assets. It shows its diversification of exports mix and rigorous commercial diplomacy.

Bright Prospects

The UAE has become hub of trade, business, investments and above all dialogue. The UAE will remain one of the attractive destinations in the region for foreigner workers due the absence of any personal taxes. Its budget does not have any deficit. The UAE economy is estimated to record an expansion of 4.0 to 4.5 percent this year, while the IMF has predicted a growth of 4.5 percent in 2015, confirming that the fall in oil prices will neither affect budget nor weigh on growth.

Booming Non-Oil Sector

Its non-oil sector is booming and expanded to 61.2 percent during 2014. The sector still shows solid growth even in 2015. According to ADCB the UAE’s real non-oil growth will accelerate to 5.6 percent in 2014 and remain within the 5 to 6 percent during the 2014-2016 period, above the average of 4.3 percent posted between 2011 and 2013.

Tourism Sector

Moreover, tourism is projected to have a total value of 60 billion dirhams this year, its highest on records, while may reach 80 billion dirhams by 2024, or 12.1 percent of GDP, on expected boost in the infrastructure and hotel projects as Dubai prepares to host the 2020 EXPO.

Dubai State’s Budget 2015

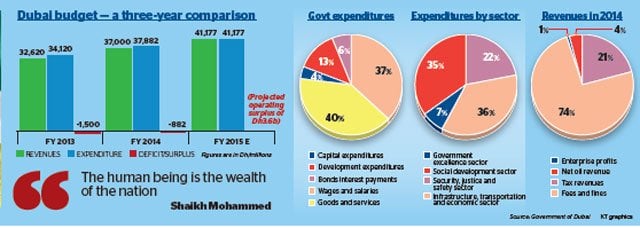

His Highness Shaikh Mohammad Bin Rashid Al Maktoum, Vice-President and Prime Minister of the UAE and Ruler of Dubai, has approved the largest budget for Dubai since the global financial crisis at Dh41 billion, up 9 per cent from 2014.

Continuation of Federal Government Strategy

The state budget is in consistence with initiatives and projects and assigned allocations in the Federal Government strategy for the same period in tandem with the zero-based budget framework.

Surplus Budget

The government silenced its critics by announcing its Dh41 billion budget for 2015. It has an operating surplus of Dh3.6 billion, the first ever since the global financial crisis in 2008. The budget also has a humane face with 71 per cent of expenditure allocated to social sector development and infrastructure spending to create more jobs and stimulate the economic growth of the emirate.

According to the state budget spending is set to increase by nine per cent in the fiscal year 2015 while revenues are projected to be up 11 per cent.

Different Sectors Utility State Budget’s Allocations %

Social Uplifting of health, education, housing and community development projects. 35

Infrastructure, transportation and economic sectors Infrastructural development, logistic means and integrated economic sectors/sub-sectors 36

Security, justice and safety sectors Home-land security, justice administration etc. 22

Government excellence sector Different organs of the state 7

The above table clearly shows state clear intentions by allocating more funds to the social sector and infrastructure development. Dubai has already diversified its economy by reducing dependence on oil revenues over a period of time. The government continues its investment in education, health and other social sector, which is a positive and right direction on path to progress and prosperity of the people.

Government’s Revenues

Shaikh Mohammed approved Dubai’s budget which shows that the government has further reduced its dependence on oil revenues, which now only contributes four per cent to the total income, compared to the five per cent in the fiscal year 2014.

Increase of Public Revenues

Furthermore, the state has successfully increased public revenues by 11 per cent compared to the corresponding period last year. Revenue from government services, which represent 74 per cent of the total government revenue, increased by 22 per cent, compared to 2014. The increase reflects the projected growth rates for the principality, and the evolution and diversity of government services. This increase is due to the remarkable real economic growth by 2014 budget, with limited increments on certain government services, and other increments designed to regulate the real estate market.

Enhanced Tax Collection

Tax revenues increased by 12 per cent of the total government revenue, compared to the fiscal year 2014, and came to represent 21 per cent of total government revenues, which include customs and taxes of foreign banks.

Economic Development Orientation

The emirate has also cut down the budget allocation from government investment returns to support the increased allocations reinvested, so as to contribute to the development of the emirate’s economic growth.

Government’s Expenditures

Major Allocation

a. General and administrative expenses, capital expenditures and grants and subsidies

1. The Dubai emirate’s budget 2015 expenditures break-up shows that a major allocation of 40 per cent is made for general and administrative expenses, capital expenditures and grants and subsidies in order to provide better government services to citizens and residents in the emirate.

b. Wages and salaries

2. The second major allocation of 37 per cent in government expenditure is reserved for wages and salaries, underscoring the government’s desire to support recruitment and human resource development in the emirate.

c. Creation of new jobs

3. The government has made a provision for 2,530 new jobs for citizens during the fiscal year 2015 in line with the continuation of the settlement policy under which it created 1,650 posts in fiscal 2014.

Government’s Support to infrastructure projects

The Dubai government continues to support infrastructure projects by allocating 13 per cent of its spending to infrastructure. Dubai is planning to maintain the size of its investments in infrastructure over the next five years.

The interest of the government in dealing with loans seriously is reflected in the six per cent allocation for debt service. About four per cent is allocated for capital expenditures in the fiscal year 2015.

Comparative Study of Government’s Revenues-Expenditures

The comparative study of the Dubai’s budget clearly indicates that it has come as a result of strict financial policies of the Supreme Fiscal Committee, which focused on increasing spending for the development of the sectors such as infrastructure, communications, security, justice and safety, government services and excellence, and social development. Moreover, the government’s success in achieving no-deficit balance is a result of applying prudent fiscal policies.

Conclusion

The United Arab Emirates Federal Budget is people and business friendly. It is development oriented. It is investment and service oriented. It upholds the importance of social development by allocating major funds of budget 2015. It is tax free budget. It creates new jobs. It promotes business activity in the country. The federal budget of UAE will not be affected by falling oil prices. The volume and value of approved expenditures at next year’s budget will not change.

The UAE federal and Dubai state budgets have been prepared to promote human resources in the country. To create/achieve balance in the governments revenues-expenditures both the budgets have been prepared with rule of using recurrent revenues to finance recurrent expenditures, which is one of the sound scientific bases of fiscal policy. It is hoped that the operating surplus of Dh3.6 billion will contribute to the financial sustainability of the principality.

Its zero-deficit budget suggests that the funds are allocated on calculative based on the priorities using its own resources. It also indicates that Dubai has learnt from the past miscalculations and has become more focused and disciplined. The state budget shows the government dependents its own indigenous resources. It shows rapid recovery which achieves through increase in public finances.

Health, education, housing, and social services sectors are the main beneficiaries of the budgets. It is important, therefore that fiscal prudence continues because positive economic trends can influence the growth of fiscal deficits if not checked, as increased levels of economic activity generally lead to increase of the above mentioned outlays.